Your Guide to Navigating the SBA Loan Landscape

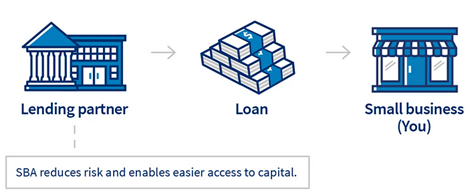

As a business owner, getting the money you need is like finding the right map to reach your destination. SBA loans, backed by the U.S. government, are like a special guide that can help you find the right path. But before you start, it’s important to know exactly where you’re going.

Know Your Needs

Before you even talk to a lender, figure out what you need the money for and how much you’ll need. This will help you find the right SBA loan program and make sure you’re getting the right type of financing for your business.

Brokers: Your SBA Loan Experts

Think of SBA loan brokers as experienced guides who know all the ins and outs of SBA loans. They can help you find the best lender, negotiate better terms, save you invaluable time and energy, and make sure you understand everything before you sign on the dotted line.

Not All Lenders Are Created Equal

Just like there are different types of maps and routes, not all SBA lenders are the same. Some have fixed interest rates, which means the rate won’t change over time, while others have variable rates, which means the rate can go up or down depending on the market or other reasons.

Knowing even just this piece alone can keep you from making wrong assumptions and save you some headaches (and money!) along the way.

Make Informed Choices

By knowing your exact needs, working with a broker you trust, and understanding the different types of loans that are applicable and available to you, you can make informed decisions about your SBA loan. This will help you get the financing you need to make your business dreams come true.

If you’re still shopping around for a loan broker or would like to explore your current SBA loan options with someone who is experienced and knowledgeable in this field, visit www.pacificbusinessfunding.com and schedule a free consultation. You can use this time to find out what else you need to do to prepare for getting the right SBA loan for you.

We believe that small businesses like yours are the heart of our economy, and we are committed to helping you succeed. We hope you found this helpful and that you feel more empowered to grow your business and get those projects funded!

-The Pacific Business Funding Team

P.S. If you are a visual learner, check us out on YouTube 👇🏼

What You Need to Know About SBA Loans that Google Won’t Tell You [2024]